Amna Akhtar

October 14, 2025

Leaders are drowning in dashboards but starving for decisions.

Every quarter, your business generates more reports, more charts, and more metrics. Yet, you still find yourself waiting for answers when you need them most during the board call, in a customer crisis, or during a market shift.

Traditional BI gave you a single source of truth, but not the speed or foresight required for modern decision-making. Conversational analytics for leaders made things faster by letting you “just ask,” but most tools stop at answers. Speed without predictive, actionable intelligence still keeps you reacting instead of leading.

This guide is your 90-day playbook for moving from reporting to prediction to action and building a culture of decision velocity. You’ll see how conversational analytics, when combined with predictive analytics for leaders, governance, and closed-loop execution, can transform data into outcomes and make leadership faster, smarter, and more proactive.

Dashboards gave you visibility. Conversational analytics for leaders give you speed.

But if you’re still asking “what happened?” instead of knowing “what’s next?” you’re stuck in the reporting trap.

Most BI tools are slow, descriptive, and analyst dependent. They tell you what happened, often weeks later, leaving your teams scrambling to react. By the time you review the report, the opportunity has passed.

Worse, they require you to hunt for insight manually, clicking through charts, comparing time periods, and interpreting trends instead of simply surfacing the next action you should take.

Conversational analytics for leaders promised a faster path: just ask a question, get an answer.

But for many platforms, the interaction ends there. They stop at answers, not decisions.

A sales leader can ask, “What were last quarter’s numbers?” and get a chart. But it won’t tell you which segment will underperform next quarter. It won’t explain why churn is creeping up. It won’t recommend what to do right now to fix it.

This gap between answers and action keeps leaders stuck in reactive mode.

Business Pulse is purpose-built for leaders who want every decision backed by data they can trust.

With Business Pulse, you don’t just see what’s happening. You know why, you know what’s next, and you know what to do – all in one place.

Business Pulse is more than a chat interface. It combines natural language queries with predictive modeling, causal analysis, and prescriptive intelligence, all governed by a semantic layer that ensures consistency and trust.

The result is not just faster answers. It is decision velocity – the ability to see around corners, act with clarity, and scale those actions across your organization.

To move beyond insight and into reliable decision-making, conversational analytics for leaders need more than raw predictions. They need a system built on trust, clear KPI alignment, and a governance layer that ensures every action is safe, auditable, and explainable. Business Pulse was purpose-built to deliver exactly that.

Business Pulse begins by aligning metrics to a single source of truth. Semantic grounding ensures terms like revenue, churn, and CAC mean the same thing across finance, sales, and operations. This eliminates the “dueling dashboards” problem and gives executives confidence that every insight and prediction is grounded in consistent, trusted data.

Once the foundation is in place, Business Pulse moves beyond static reporting with its predictive core: forecasting to anticipate trends, anomaly detection to surface risks early, and driver analysis to uncover what’s really behind performance shifts. Predictive analytics for leaders aren’t limited to simply observing these insights. They can run what-if scenarios right inside the conversational interface. “What if we cut acquisition spend by 10%?” or “What if we shift production to a new vendor?” The system models outcomes instantly, allowing executives to choose the scenario with the highest impact before committing resources.

Of course, these what-ifs are only as valuable as the accuracy behind them. Speed means little without trust. Business Pulse validates data inputs across CRMs, ERPs, and marketing platforms, applies automated checks, and surfaces clear lineage so executives know every outcome is grounded in reliable information.

Accurate data doesn’t just prevent costly mistakes, it turns scenario modeling into confident decision-making. Paired with prescriptive analytics for business leaders, accuracy ensures next-best-actions aren’t just fast but strategically sound.

Where other conversational analytics platforms may offer quick insights without context, Business Pulse closes the loop by combining rapid analysis with verified data quality. Leaders move decisively, knowing every forecast, recommendation, and what-if outcome is explainable, reliable, and tied to a single source of truth.

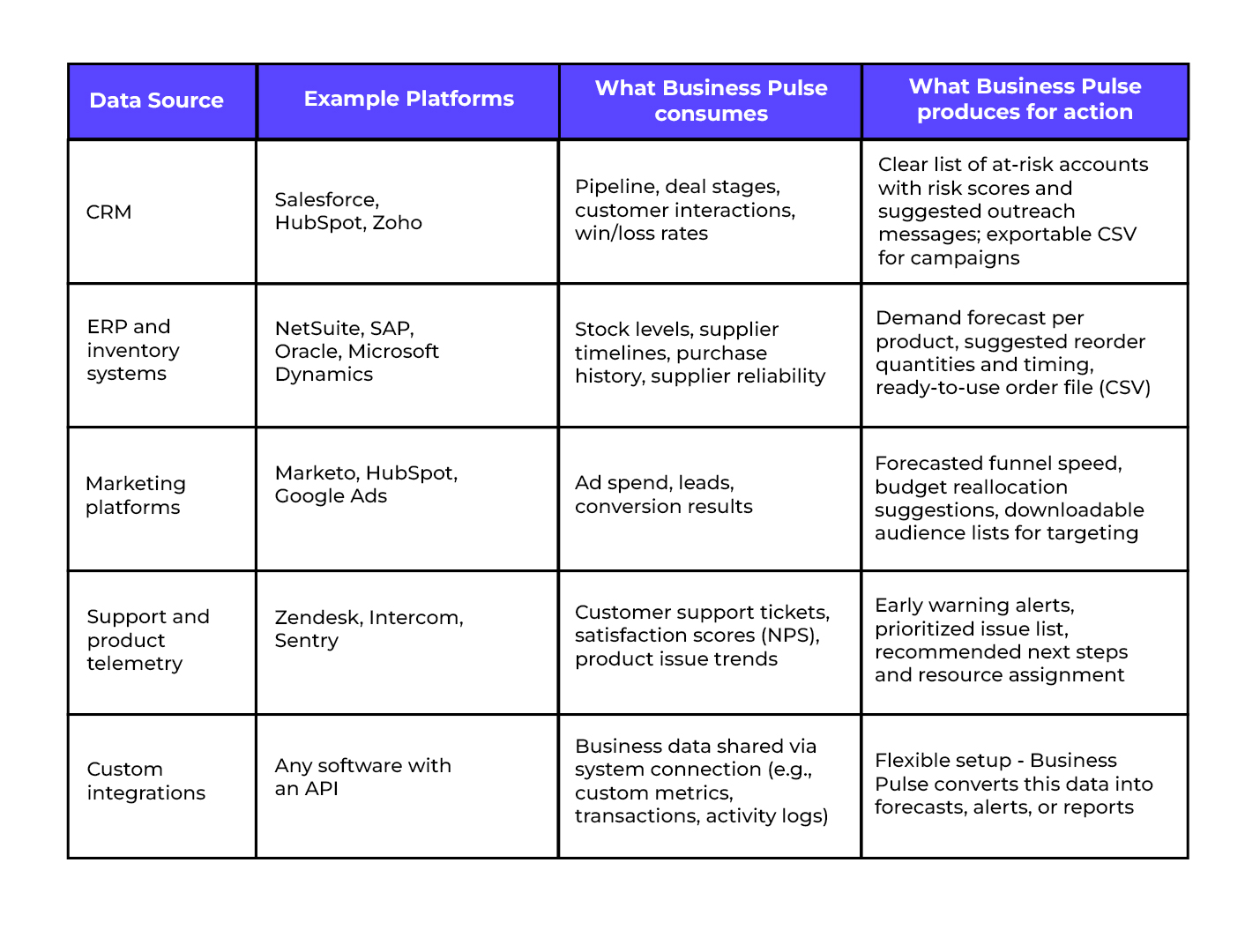

Insight becomes valuable only when it is turned into action inside the systems your people use every day. Business Pulse sits at the center of that loop as a question-driven analytics layer. It reads your CRM, ERP, marketing, and support data, it surfaces forecasts and driver analysis in plain language, and it produces clear next steps your teams can act on. It does not itself run campaigns or place purchase orders. Instead, it gives conversational analytics for leaders the decision-ready outputs and artifacts needed to act fast and safely.

Business Pulse connects to data in two main ways. First, it connects to systems via native connectors and APIs. Common integrations include CRM platforms like Salesforce, HubSpot, and Microsoft Dynamics; ERP systems such as NetSuite, SAP, and Microsoft Dynamics 365; marketing platforms including Marketo, HubSpot Marketing, Google Ads, and Facebook Ads; and support platforms like Zendesk and Intercom. Second, it can read from your central data store or warehouse, for example Snowflake, BigQuery, or Redshift, when teams centralize ETL/ELT there.

And if you don’t see your platform on this list? Don’t worry, Business Pulse supports custom integrations. As long as your system has an API, we can connect to it, making the platform extensible to virtually any software in your stac.

While the table shows which systems Business Pulse connects to and the outputs it generates, what matters most is how these outputs translate into real executive decisions. The following scenarios illustrate how a CEO or business leader can move from raw data to clear next steps without waiting for reports or second-hand analysis.

You ask Business Pulse, “What is our churn risk over the next 30 days?” Using CRM activity and support data, the platform forecasts churn to rise 12 percent, driven mainly by declining product usage among mid-tier accounts in APAC. It provides a ranked list of affected accounts with engagement metrics, along with a ready-to-use playbook that includes messaging templates, priority tiers, and estimated impact. Your Head of Customer Success can download the list as a CSV, import it into Salesforce or HubSpot, and immediately attach the playbook to outreach tasks. The decision loop is shortened because you got the cause, the who, the how, and the expected impact in one conversation.

You ask, “Which products are at risk of running low in the next 60 days?” Business Pulse runs demand forecasts against sales history and seasonality data, then returns SKU-level projections, recommended reorder quantities, and notes on supplier lead times. It generates a purchase-order-ready file that procurement can review and upload directly into NetSuite or hand to the sourcing team. Approvals and final orders still sit with procurement, but they act earlier and with higher confidence because the reorder list and rationale were produced in one conversational exchange. For executives, this bridges the gap between business intelligence dashboards and immediate operational action.

Complex business environments demand structured ways to evaluate trade-offs. Conversational analytics for leaders often face critical questions about growth, retention, supply chain stability, and customer experience: questions where timing and precision can make or break outcomes. Business Pulse turns these high-stakes decisions into repeatable playbooks, helping executives quickly frame problems, test scenarios, and choose the best course of action with data-backed confidence.

Revenue targets are rarely missed because of one factor: it’s usually a mix of pipeline quality, conversion rates, and acquisition efficiency. Without a way to run quick projections, leaders are left guessing how much to invest in which levers.

With a single query, executives can pull live pipeline forecasts directly from connected CRMs like Salesforce, HubSpot, or Zoho. If the forecast shows a gap, they can run what-if scenarios by adjusting variables like ad spend, conversion rates, or sales velocity to see their potential impact on bookings before making budget decisions. This is where predictive analytics for leaders takes shape in a way that’s instantly actionable.

You’re six weeks out from the end of quarter. Business Pulse shows that pipeline coverage is at 0.8x instead of the 1.2x needed for target attainment. You test the scenario: “What if we reallocate 15% of paid media spend to the highest-performing channel?” The model projects a 10% lift in opportunities with the lowest incremental CAC, helping you greenlight the change with confidence.

Retaining customers is often cheaper than acquiring new ones, but without clear visibility into churn risk, retention spending can be unfocused and reactive.

Executives can ask, “Which customer segments are likely to churn next quarter?” and instantly get a ranked list by risk level. Business Pulse draws from product usage data, support tickets, and payment history to surface patterns that drive churn. Leaders can then model different budget allocations for example, shifting funds from broad loyalty programs to targeted recovery efforts for high-value accounts. With prescriptive analytics for business leaders, these decisions are optimized instead of reactive.

Business Pulse reveals that customers with declining weekly logins and multiple open tickets represent 40% of next quarter’s projected churn. Instead of spending on generic campaigns, you prioritize targeted retention offers for this segment, improving ROI on retention spend and protecting recurring revenue.

Even small supply delays can lead to revenue loss or expensive emergency replenishments, but most leaders don’t see the risk until it’s too late.

By connecting to ERP systems like SAP, NetSuite, or Microsoft Dynamics, Business Pulse can highlight SKUs likely to go out of stock based on demand forecasts and vendor lead times. Executives can then simulate scenarios such as vendor delays or demand spikes and view their downstream effects on fulfillment rates and inventory costs. Here, conversational analytics for leaders deliver foresight that drives operational resilience.

You query Business Pulse: “Which products are at risk of stockouts in the next 30 days?” It flags your top-selling SKU, projecting a 15-day gap if current lead times hold. You test a scenario where production is expedited by one week, and Business Pulse shows the revenue protection gained versus the additional cost, enabling you to make a well-informed trade-off decision.

Poor customer experience can quietly erode loyalty before churn metrics even move. Detecting anomalies early allows leaders to intervene proactively.

Executives can ask, “Where are we seeing unusual dips in NPS or support response time?” and immediately view the regions, channels, or teams affected. Business Pulse pairs anomaly detection with causal insights, so leaders can focus on the root issue rather than chasing symptoms. With Conversational BI for CEOs, these insights are surfaced in real time, not after the damage is already done.

Business Pulse detects a 12% increase in unresolved support tickets for enterprise customers in EMEA, predicting a likely drop in satisfaction scores if left unaddressed. You can then direct operational teams to add capacity to that queue before the customer experience deteriorates further.

These decision playbooks give executives a repeatable way to move from uncertainty to clarity in minutes. By consolidating data across systems, surfacing predictive signals, and allowing leaders to test scenarios in real time, Business Pulse reduces the lag between insight and executive action which can mean the difference between hitting or missing targets.

Most leaders agree that data-driven decision-making is critical but few know where to begin. The real challenge isn’t “getting more data”; it’s knowing which questions to answer first, which teams to involve, and how to build trust in the insights. This is exactly where conversational analytics for leaders provides the clarity and focus needed to start right.

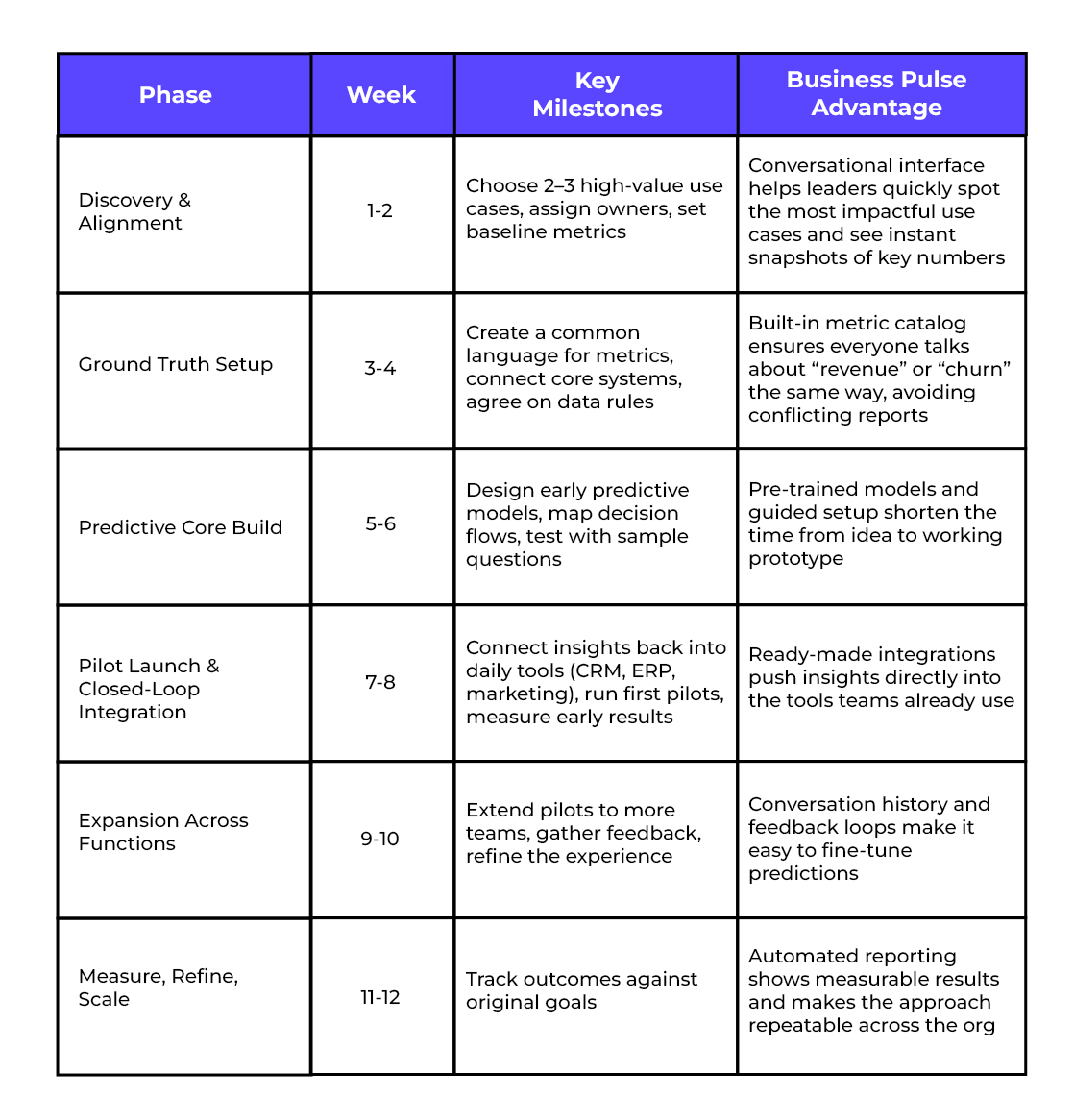

This 90-day blueprint gives you a practical, step-by-step playbook to move from static reports to predictive insights that guide real decisions. By following this plan, you’ll go from identifying 2–3 high-value predictive use cases to running live pilots, measuring outcomes, and building a repeatable playbook your teams can scale across the enterprise. With predictive analytics for leaders integrated into every step, you’re not just analyzing data you’re building a culture of foresight.

Think of it as a 12-week sprint designed to:

Goal: Identify 2–3 use cases that will deliver measurable business value within 90 days.

A SaaS company sees churn creeping up to 8.5%, putting $10M ARR at risk. They choose “churn prediction for mid-market accounts” as their focus. Business Pulse captures the baseline: renewal rate = 91.5%, average deal size = $40K, renewal cycle = 60 days.

Goal: Build a single source of truth and ensure the data is accurate and consistent.

Business Pulse keeps all your metrics in one place, fully queryable as a single source of truth. With automatic data source integrations, teams fix inconsistencies fast and leaders stop debating “whose number is right.” Everyone works from the same trusted baseline.

The team connects Salesforce, usage logs, and Zendesk. They discover “active user” was defined differently across regions. Business Pulse helps standardize the definition and reconcile revenue numbers, creating one reliable churn baseline.

Goal: Build early predictive models, test them, and design the executive experience.

Predictions surface in conversational form, so leaders can “test drive” the questions they’ll ask before launch. Instead of sifting through technical dashboards, they interact directly with the insight.

A churn model surfaces three clear drivers:

Business Pulse can now answer: “Show me accounts with churn risk above 70% and <$50K ARR,” returning a ranked list with explanations.

Goal: Run a live pilot to prove insights and change decisions.

Produces clear outputs; ranked lists, explanations, and scenarios that slot directly into the pilot team’s decision cycle. Insights arrive in the exact format needed for action, not just numbers to interpret.

Customer success reps query the “Top 50 At-Risk Accounts” weekly. They launch proactive outreach: health reviews, webinars, and priority support. Churn signals are now detected 3 weeks earlier than before.

Goal: Extend the pilot to new teams and refine workflows.

Tracks usage and feedback, helping refine model thresholds and conversational outputs as more teams adopt it. This shortens the learning curve and ensures adoption beyond the pilot group.

Sales uses risk scores in QBRs. Marketing runs nurture campaigns for medium-risk accounts. The churn model improves with new inputs like customer satisfaction scores.

Goal: Show ROI and prepare for wider rollout.

Keeps scorecards updated with scheduled live data and preserves conversation history for training. Leaders see both the business impact and the decision process, making scale-up more reliable.

Pilot results: churn down to 7.2% (protecting $1.5M ARR), CSAT up 9 points, renewal cycle a week shorter. Leadership approves scaling to upsell propensity and global rollout, proof that conversational analytics for leaders can move from pilot to enterprise impact in under 90 days.

Every decision leaves a digital footprint. The real question isn’t just “Did we act?” but “Did we make the right call fast enough, and at scale?” Leaders today are measured not only by revenue but by the speed, precision, and consistency of their decisions. The real test of analytics maturity is creating a culture where insight turns into measurable impact.

Business Pulse makes this possible by transforming every question, forecast, and scenario into a measurable decision loop. It helps leaders move beyond surface KPIs to real performance management. This is where conversational analytics begins to redefine how success is measured at scale.

Decision-making speed is the ultimate competitive advantage. Business Pulse shortens the time between spotting a signal and acting on it. Whether it’s reducing the lag in quarterly planning or reacting to a sudden demand spike, faster cycle times mean opportunities are captured while competitors are still deciding.

Accurate forecasts reduce waste, prevent costly surprises, and build executive confidence. By bringing all data into one conversational interface, Business Pulse makes it easy to question forecasts, validate assumptions, and refine models in real time. For CFOs, this means committing to budgets with confidence. For supply chain leaders, it means smarter inventory planning. Predictive insights sharpen accuracy even further.

Fast decisions only matter if they’re safe and aligned. Business Pulse enforces governance by making metrics transparent, surfacing data lineage, and ensuring every team works from a shared source of truth. This reduces risk, strengthens trust, and keeps leadership aligned.

At the end of the day, the purpose of analytics is growth. Business Pulse shows how predictive insights affect revenue, churn, and customer lifetime value. When retention rates improve or pipeline conversion rises after a decision loop, leaders can directly attribute that lift to analytics-driven action. Combined with prescriptive insights, leaders don’t just see results, they’re guided on how to achieve them.

The next era of decision-making isn’t just about better reporting, it’s about evolving from reactive questioning to proactive orchestration:

The future won’t rely on one model but multiple AI agents; analyzing data, modeling scenarios, generating recommendations, and checking risks together. Business Pulse is built to integrate with these capabilities as they mature, enabling more reliable, cross-validated decision support.

Leaders are increasingly mobile. Soon, executives won’t just type questions. They’ll ask them in the moment and get spoken answers. Business Pulse will make decision-making as seamless as asking a colleague.

The most powerful decisions align finance, operations, marketing, and customer success on one shared reality. Business Pulse provides this orchestration layer, breaking down silos and ensuring predictive insights are visible across the leadership team.

Conversational analytics for leaders isn’t about dashboards anymore. Reporting is table stakes. The real advantage lies in predictive, governed, closed-loop decision-making where every insight leads to action you can trust and measure.

In 90 days, you can move from debating reports to running a system where every forecast and anomaly drives execution. That’s the difference between staying ahead and scrambling to catch up.

At Business Pulse, we believe the era of passive analytics is over. You deserve more than charts. You deserve a decision system that works as fast as you think. The companies that embrace this shift will lead; the ones that don’t will keep reacting.

The next quarter will belong to the leaders who act. Will you be one of them? Give Business Pulse a shot for free here.

Get a free Data Maturity Audit and see exactly where your reporting and decision-making can improve.

Share this Blog

With over 5+ years in content marketing, I specialize in crafting narratives that connect brands with people. My expertise spans strategy, storytelling, and digital campaigns that boost engagement and growth. Outside of work, I enjoy photography, capturing moments, and exploring creativity through the lens.